A leveraged buyout (LBO) is a financial transaction in which a company is acquired using borrowed money, which is paid off through the assets or earnings of the target company. In essence, an LBO allows an investor to control more value than what their capital resources can actually provide.

Table Of Content:

- Leveraged Buyout (LBO) Definition

- Private equity - Wikipedia

- Leveraged buyout definition and meaning | Collins English Dictionary

- LEVERAGED BUYOUT | definition in the Cambridge English ...

- definition of leveraged buyout by The Free Dictionary

- LEVERAGED BUYOUT | meaning in the Cambridge English Dictionary

- Leverage Buy-Outs - The Free Dictionary

- leveraged buyout definition

- What is Business Growth? | Meaning & Definition

- Leveraged Buyout (LBO) Definition - What is Leveraged Buyout (LBO)

1. Leveraged Buyout (LBO) Definition

https://www.investopedia.com/terms/l/leveragedbuyout.asp/GettyImages-1139045193-866686df44d34790bb9020ff3baf0855.jpg)

2. Private equity - Wikipedia

https://en.wikipedia.org/wiki/Private_equity

Leveraged buyout, LBO, or Buyout refers to a strategy of making equity investments as part of a transaction in which a company, business unit, or business ...

3. Leveraged buyout definition and meaning | Collins English Dictionary

https://www.collinsdictionary.com/us/dictionary/english/leveraged-buyout

4. LEVERAGED BUYOUT | definition in the Cambridge English ...

https://dictionary.cambridge.org/us/dictionary/english/leveraged-buyout

5. definition of leveraged buyout by The Free Dictionary

https://www.thefreedictionary.com/leveraged+buyout

6. LEVERAGED BUYOUT | meaning in the Cambridge English Dictionary

https://dictionary.cambridge.org/dictionary/english/leveraged-buyout

7. Leverage Buy-Outs - The Free Dictionary

https://www.thefreedictionary.com/Leverage+Buy-Outs

8. leveraged buyout definition

https://italodigitali.com/dbnxi/leveraged-buyout-definition

Definition of leveraged-buyout in the Definitions.net dictionary. ... as bank loans and bonds. leveraged buyout meaning: 1. an occasion when a small company ...

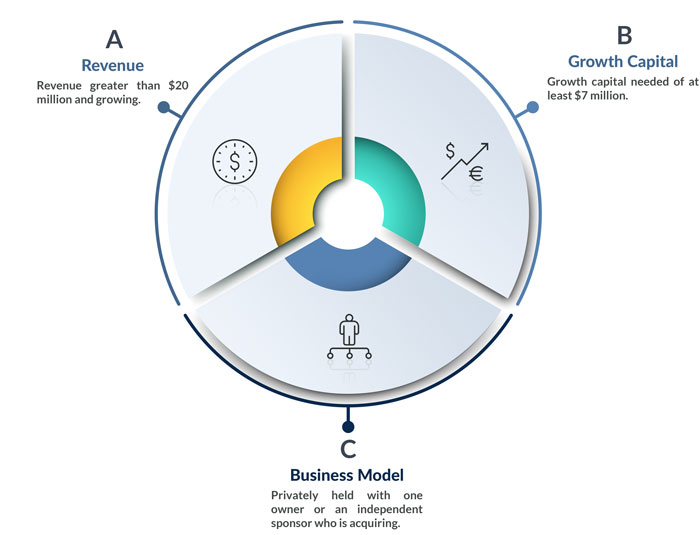

9. What is Business Growth? | Meaning & Definition

https://www.attractcapital.com/business-growth.html

10. Leveraged Buyout (LBO) Definition - What is Leveraged Buyout (LBO)

https://www.shopify.com/encyclopedia/leveraged-buyout-lbo

What is a leveraged buyout?

A leveraged buyout (LBO) is a financial transaction in which a company is acquired using borrowed money, which is paid off through the assets or earnings of the target company.

What are the advantages of an LBO?

The main advantages of an LBO are that it gives investors greater control and leverage when acquiring a company. Additionally, it can make it easier to finance the acquisition by spreading out payments over time. It also allows investors to reduce costs associated with financing by taking advantage of debt markets instead of equity markets.

What are some common disadvantages of an LBO?

The major disadvantage of an LBO is its risk factor - since much of the purchase price for an acquisition will be funded by debt, it can result in high levels of debt-servicing requirements if the deal does not perform as anticipated. Furthermore, there may be risks associated with regulatory oversight and taxation that can complicate matters further. Finally, there may be issues related to alignment between shareholders and creditors when structuring a deal.

Can any company participate in an LBO?

Generally speaking, companies wishing to participate in an LBO should have solid cash flow and well-defined growth prospects. They should also possess strong profit margins that are reliable sources of income over time, along with ample amounts of liquid assets such as cash or marketable securities. Higher quality firms generally require lower interest rates and have better access to liquidity.

Conclusion:

Leveraged buyouts can be highly beneficial for both investors and businesses alike - they allow businesses to acquire new assets while reducing their reliance on outside funding sources and providing increased control for buyers. However, not all companies may be suited for this type of arrangement due to their risk profile - therefore it is important for investors and businesses alike to carefully evaluate all potential risks before participating in any leveraged buyout transactions.