Buying a home is a big decision and involves many considerations. One of the main questions people ask when buying a home is “How much will my monthly mortgage payment be?” In this article, we will try to answer that question for anyone who is considering taking out a mortgage loan of $600k.

Table Of Content:

- How much would my payment be on a $600,000 mortgage? | finder ...

- Mortgage Calculator

- Mortgage Required Income Calculator - Capital Bank

- $600,000 Mortgage

- 600k Mortgage | Mortgage on 600k - Bundle

- Mortgage Calculator from Bank of America

- Mortgage Calculator: Calculate Your Mortgage Payment – Forbes ...

- How Much Is A Down Payment On A House? | Bankrate

- Down Payment Calculator | How much to put down on a house | U.S. ...

- 600k Mortgage | Mortgage on $600,000

1. How much would my payment be on a $600,000 mortgage? | finder ...

https://www.finder.com/600000-mortgage

2. Mortgage Calculator

https://www.calculator.net/mortgage-calculator.html

The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. There are options to include ...

3. Mortgage Required Income Calculator - Capital Bank

https://capitalbankmd.com/homeloans/mortgage-calculators/mortgage-required-income-calculator/

4. $600,000 Mortgage

https://www.mortgagecalculatorplus.com/600000-mortgage/How much would the mortgage payment be on a $600K house? ... Assuming you have a 20% down payment ($120,000), your total mortgage on a $600,000 home would be ...

5. 600k Mortgage | Mortgage on 600k - Bundle

https://bundleloan.com/blog/600k-mortgage/

6. Mortgage Calculator from Bank of America

https://www.bankofamerica.com/mortgage/mortgage-calculator/

7. Mortgage Calculator: Calculate Your Mortgage Payment – Forbes ...

https://www.forbes.com/advisor/mortgages/mortgage-calculator/

8. How Much Is A Down Payment On A House? | Bankrate

https://www.bankrate.com/mortgages/how-much-is-a-down-payment-on-a-house/

9. Down Payment Calculator | How much to put down on a house | U.S. ...

https://www.usbank.com/home-loans/mortgage/mortgage-calculators/down-payment-calculator.html

10. 600k Mortgage | Mortgage on $600,000

https://smarts.co/600k-mortgage/

The monthly payment on a $600,000 mortgage is $3,477. You can buy a home worth $667,000 with a $67,000 down ...

What factors determine the mortgage payment amount?

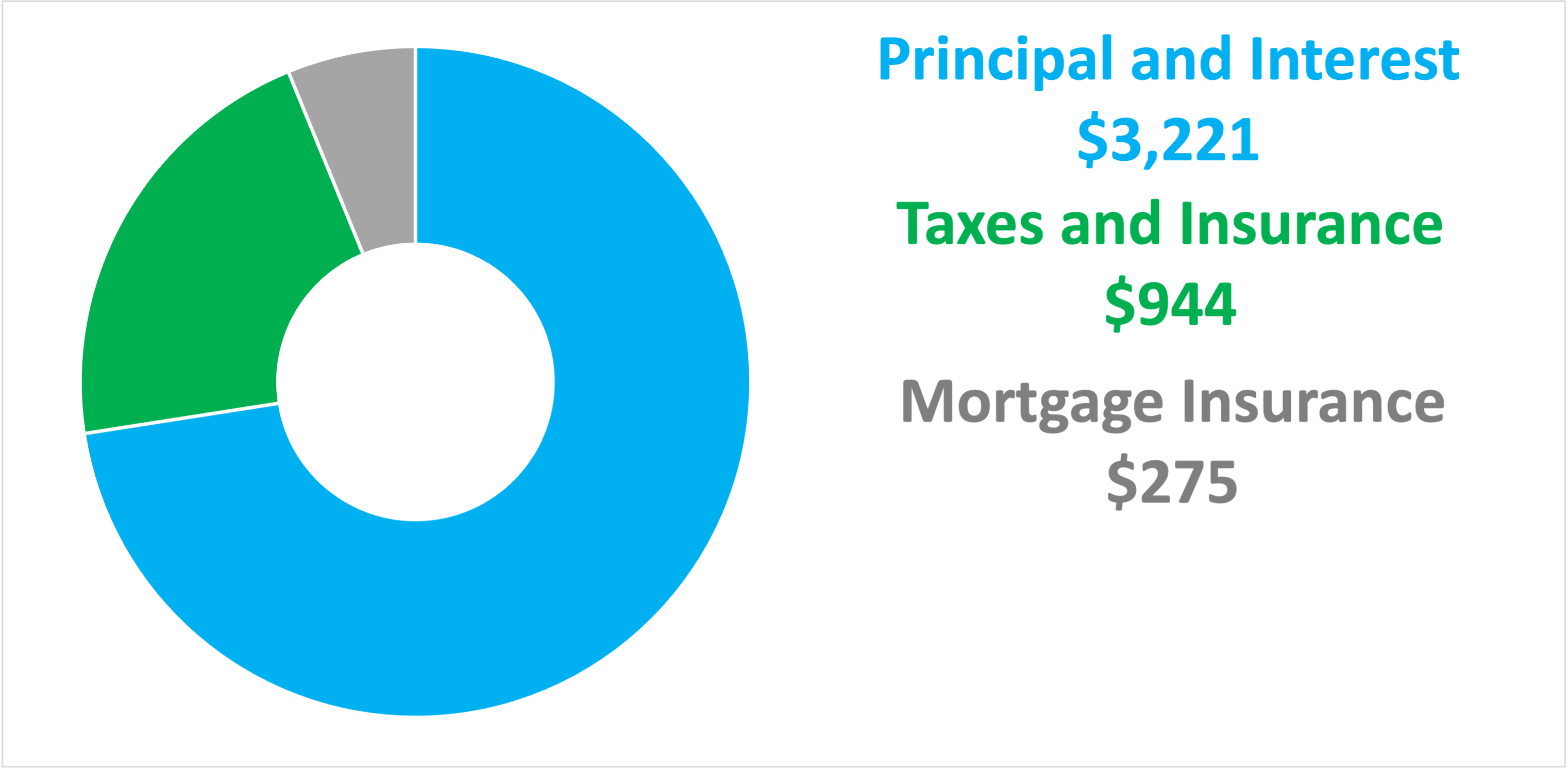

The amount you pay for your monthly mortgage payment depends on the interest rate associated with the loan, as well as the term length of the loan (15 year or 30 year). Other factors such as taxes, insurance, private mortgage insurance and homeowner association fees may also affect your total monthly payment.

What would be an estimated monthly payment on a $600k loan?

An estimated monthly payment on a 30-year fixed rate mortgage of $600k at 4% interest rate would be approximately $2,873 per month.

Are there any other fees associated with this loan?

Yes, in addition to your principal and interest payments each month, you may need to pay for closing costs when you take out the loan and property taxes at least once a year. Depending on where you live and what type of loan you get, there may also be private mortgage insurance (PMI) if you put less than 20% down on your home purchase. Additionally, some locales have homeowner association fees or other assessments that can add to your total cost each month.

What are some tips for reducing my monthly payment?

There are several ways to reduce your monthly mortgage payments. You could opt for an adjustable-rate mortgage (ARM) instead of a fixed-rate one which usually has lower initial rates but carry with it more risk. You could also look into making bi-weekly payments which reduces the sum over time because more money goes toward paying off principle each month. Additionally, putting 20% down or higher can help eliminate PMI costs and reduce overall interest paid over time.

Conclusion:

Taking out any type of loan is always a big decision and understanding how much your monthly payments will be is key in budgeting correctly so that you don't end up spending more than what you can afford comfortably each month . Doing research ahead of time can help ensure that when it comes time to make those payments they don't derail all other financial goals in place..